additional net investment income tax 2021

April 28 2021 The 38 Net Investment Income Tax. The Affordable Care Act of 2010 included a provision for a 38 net investment income tax also known as the Medicare surtax to fund Medicare expansion.

Taxation Of Investment Income Within A Corporation Manulife Investment Management

The 38 Net Investment Income Tax under Internal Revenue Code Section 1411 would be broadened to include any income derived in the ordinary course of business for single filers with more than.

. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. However what you apply the 38 to depends. Its just 38 which means you take your earnings and multiply them by 0038.

Like the additional. B the excess if any of. The threshold amount varies depending on the taxpayers filing status.

The second tax faced by high-income taxpayersthe Net Investment Income Tax NIITis a 38 percent tax on qualifying investment income such as interest dividends. The NIIT is a 38 additional tax on the lesser of net investment income or the. All the US tax information you need every week Just follow me on Twitter VLJeker listed in Forbes Top 100 Must-Follow Tax Twitter Accounts 2017-2021.

Posted July 1 2021. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. Made in 2021 are divided between spouses in the same ratio as their incomes not subject to federal withholding for the 2021 tax year.

For a child who must file a tax return Form 8615 Tax for Certain Children Who Have Unearned Income is used to calculate the childs tax and must be attached to the childs tax return. However there are tax penalties for high income earners that you should be aware of. 250000 for joint returns and surviving.

2022-01-07 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of individuals estates and trusts that exceed statutory threshold amounts. Modified adjusted gross income over a certain. If your net investment income is 1 or more Form 8960 helps you calculate the NIIT you owe by multiplying the amount by which your MAGI exceeds the applicable threshold or your net investment incomewhichever is the smaller figureby 38 percent.

The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year over the threshold amount Sec. It applies to taxpayers above a certain modified adjusted gross income MAGI threshold who have unearned income including investment income such as. In the case of an estate or trust the NIIT is 38 percent on the lesser of.

Such owners may also be able to avoid the additional 09 Medicare tax that applies to wages and self-employment income above 200000 for single filers and 250000 for. A Married Filing Jointly household has 300000 in income from self-employment and 10000 in dividends. A child whose tax is figured on Form 8615 may be subject to the net investment income tax NIIT.

Who is liable for paying the net investment income tax. Overview Data and Policy Options. Any taxpayer who has net investment income in any amount and modified adjusted gross income MAGI in excess of 200000 for single.

A the undistributed net investment income or. Net investment income for the year. And a 38 Net Investment Income Tax on income over 200K250K.

The Net Investment Income Tax NIIT is an additional tax that is paid by those with high income. This tax only applies to high-income taxpayers such as single filers whose MAGI exceeds 200000 and married couples whose MAGI. But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage.

If your Modified Adjusted Gross Income exceeds 200000 or 250000 if youre married and filing jointly you may be subject to the NIIT. Your additional tax would be 1140 038. This same couple realizes an additional 100000 capital gain for total AGI of 350000.

Plus 145 Medicare tax on unlimited income. The investment income above the 250000 NIIT threshold is taxed at 38. But not everyone who makes income from their investments is impacted.

Additional Medicare tax withholding from line 24 of federal form 8959 net investment income tax from federal form 8960 and federal section 965 net tax liability payments are not added back on line 28. Your net investment income is less than your MAGI overage. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold.

2021 Capital Gains Tax Rates and Brackets. All of the dividends will be taxed at 38 for a total of 380. The Net Investment Income Tax NIIT or Medicare Tax is a 38 Surtax imposed by Section 1411 of the Internal Revenue Code on investment income.

When you trigger the high-income threshold for the Medicare surtax then you could pay 38 29 Medicare plus 09 surtax on some portions of your income. Individuals estates and trusts that paid significant amounts of the 38 net investment income tax or the 09 additional Medicare tax in 2016 or later years should consider filing protective claims for refund of those taxes that may become available subject to the outcome of litigation pending before the Supreme Court of the United StatesContinue Reading. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

An additional Medicare tax of 09 also applies to earned income subject to employment taxes. The tax is calculated by multiplying the 38 tax rate by the lower of the following two amounts. All About the Net Investment Income Tax.

Further due to tax reform there is a 10000 State And Local Income. You then enter your NIIT liability on the appropriate line of your tax form and file Form. This is a matter to be carefully examined with your tax return preparer.

The net investment income tax also known as the unearned income Medicare contribution surtax is an additional 38 tax applied to net investment income as of 2021. For example you must pay a 62 FICA tax for the first 142800 as of 2021. Additional information from the IRS about the NIIT can be found here and here.

For estates and trusts the 2021 threshold is 13050. Your net investment income aka the difference between the sale price and purchase price The portion of your modified adjusted gross income that goes over the threshold. 4 2021 the court held.

More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status. 1 net investment income or 2 magi in excess of 200000 for single filers or head of households 250000 for married. The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the extent the net amount exceeds a threshold.

This can include those who regularly have high income and those whose tax is high in one or more years due to a significant transaction such as the sale of a business or real estate. Youll owe the 38 tax.

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Paycheck

Self Employment Tax Rate Higher Income Investing Freelance Income

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What Is The Net Investment Income Tax And Who Has To Pay It Bankrate

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Dividend Tax Rates In 2021 And 2022 The Motley Fool

/GettyImages-936538294-5135a50424a1482f87af9b4078b03aba.jpg)

Net Investment Income Nii Definition

Income Tax Brackets For 2022 Are Set

What Is The The Net Investment Income Tax Niit Forbes Advisor

Income Tax Brackets For 2022 Are Set

What You Need To Know About Capital Gains Tax

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

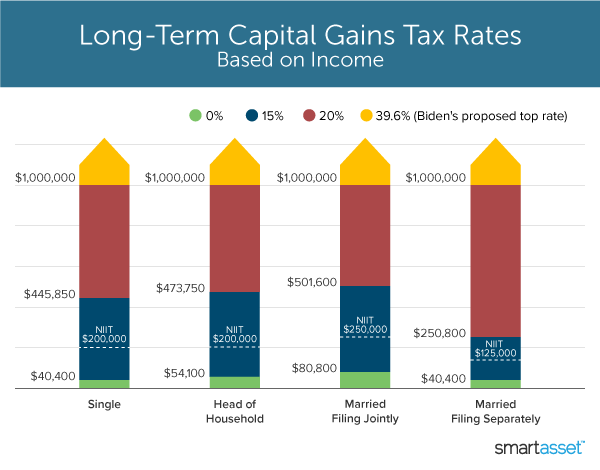

What S In Biden S Capital Gains Tax Plan Smartasset

Easy Net Investment Income Tax Calculator

Form 8615 Tax For Certain Children With Unearned Income Jackson Hewitt